The next big decision likely facing the United States Congress after the failure of legislation to undo the Affordable Care Act is probably not, as you have been reading, tax legislation or infrastructure program legislation. No, it is that nasty item called the debt ceiling.

It is not supposed to be a big hard decision but it could well be if the Republican Party again insists on making it so. Because it did that 17 months ago, the United States is in the proverbial pickle barrel.

And this time it is a big, big, big, big problem because since November 2, 2015 to right now, the U.S National debt has risen $1.41 trillion and it has not been acknowledged because of a really peculiar law that took effect that day. More about that as we go one.

Unnoticed and lost in the shuffle amid all the clamor and confusion surrounding the catastrophic legislative clown show that was the health care legislation is this:

On March 16, technically, the United States of America went if not into default then into fiscal imbalance on its way to default when the 2015 suspension of the debt ceiling expired.

Section VIII of Article I of the U.S. Constitution, spells out the “Powers of Congress”. In its second paragraph it declares, “The congress shall have the power … To borrow money on the credit of the United States.”

Because the government of the United States has had zero national debt but once in its history, a brief meaningless moment during the term of President Andrew Jackson, the Congress, using this power, has always authorized the nation to borrow.

It does that after the fact, not before, by voting to raise the debt ceiling to honor borrowing already taken by the U.S. to run its government and meet all authorized government obligations incurred during the period from the last time the Congress raised the debt ceiling. It is not a vote to borrow more but to fund what has already been borrowed, otherwise the government literally runs out of cash.

Exercising its exclusive power to borrow money, Congress has never let the executive simply borrow whatever it needs to fulfill the requirements of the federal budget. It has always required the executive branch to return to Congress to gain authorization for the money that has been borrowed by the nation – by all of us acting through our elected representatives.

It is not the president who passes budgets and authorizes spending or debt. It is the Congress.

Lifting the debt ceiling used to be an ordinary and regular event. Since 1962, for example, it has been raised 74 times. Since 1980, the year Ronald Reagan was elected president, it’s been raised 42 times – 18 times under that most conservative of fiscal conservatives, President Reagan.

Here’s a straightforward explanation:

If today, let’s say, right now, this very day, the United States has to borrow $100 to meet federal spending obligations because federal budgets, appropriations and budget authorizations (there are differences with distinctions among those terms) require that spending — say for a new missile, the payroll at the National Institutes of Health, Secret Service protection at Trump Tower, a Social Security check to a recipient, whatever — it can do that.

But, eventually, the executive branch, which is charged with paying those bills, has to return to Congress to get approval for what the nation — not the president, but the nation — has spent so that it can keep on spending what Congress authorized be spent.

This is called the debt ceiling. As observed earlier here, it’s never really been a problem until lately. Congresses knew and understood the money they authorized to be spent and appropriated for spending had to be made good because if it wasn’t or isn’t then something called “the full faith and credit of the United States” is called into question.

In simplest terms, if you welsh on a debt, who will lend you money the next time? Or, if someone will, are they not likely to raise the interest rate and thereby sharply increase your cost of borrowing if you miss a payment? People have full faith in you and give you credit on it until – until they don’t.

If that happens because the United States won’t or can’t pay its bills then who can trust anyone with anyone else’s money? If you can’t rely on “the full faith and credit of the United States,” whom can you trust? The question answers itself, doesn’t it?

What is feared from such a predicament, from a default on its debt by the United States? It is feared by really smart economists, who are supposed to know about this stuff that markets will crash, bonds will crater, commerce will screech to a halt, banks will be run on if not over.

It is feared that every debt owed by everyone in the world to anyone else in the world – from your mortgage and car payment or credit card balance to what the biggest corporations in the world owe the biggest banks in the world, even what one nation owes another nation — will suddenly teeter and totter in a toppling worldwide economy.

Don’t laugh or shake your head no, there are plenty of economists and fiscal experts who warn it could happen.

This is compounded by the fact that the U.S. dollar is the world’s reserve currency. This means if you live in another country and its economy is a mess, if your country’s economy is in an inflationary death spiral — there is one thing you can trust and substitute in your economy and national budget to steady the ship. It’s the U.S. dollar, which is why every government in the world that can afford to has a stash of U.S. currency locked away in its foreign reserves for its national rainy day.

But what if it rains in the United States because we welsh on what we owe? What then? Well, many economic and financial experts say it could pour financial chaos all over the world. Think multiples of Lehman Brothers.

So there is a lot riding on raising the debt ceiling each time it comes around. Until 2010, it was automatic. Everyone in Congress knew the deal and even if they were what are called “flinty fiscal conservatives,” they did their constitutional duty and voted to maintain the full faith and credit of the United States.

Then came the 2010 congressional election, which returned a new element to the Congress in the form of about 30 to 40 people who called themselves the Tea Party. Later they renamed themselves the Freedom Caucus. They’re the ones who took down Trump and Ryan on that unhealthy health legislation — for the wrong reasons but thankfully they did. They get elected as Republicans, but are they really?

When they got to Congress in 2011 and the routine matter of raising the debt ceiling came around, these unschooled, stupendously ignorant folks said no, they would not do that. No one could convince them that on the other side of their refusal to honor the debts of the United States lay unmitigated fiscal, financial and economic catastrophe and collapse

Although their triumphant wave in the 2010 election put Republicans in control of the House of Representatives, their party leadership under then Speaker John Boehner could not convince the Freedom Caucus that they simply had to – had to — vote to raise the debt ceiling; even when Mr. Boehner came back from the Obama White House with a big compromise that included strict spending limits and a pledge of tax law overhaul in return for raising the ceiling.

In the end, Democrats in the House joined a minority of the Republican majority to approve a debt ceiling increase and keep the United States of America in business. But that was not the end of it because it came around again and again. Finally in 2015, with Republicans now in control of the House and the Senate, Congress voted to sort of raise the debt ceiling by winking and “suspending” it.

On Nov. 2 that year, Congress voted and President Obama signed the law to suspend the debt ceiling until March 15, 2017. That law says the limit on the federal debt “shall not apply for the period beginning on the date of the enactment of this Act and ending on March 15, 2017.” Obviously, we’re there and we have been for nearly two weeks as this is being written.

In effect this law temporarily surrendered Congress’s Article I, Section VIII, Paragraph 2 power to borrow on behalf of the U.S. For all intents and purposes, the Congress voted to let the executive branch continue to borrow to fund the government, paying the bills the congress had voted to authorize to finance the government, but without making good on the borrowing for the past 17 months.

Wanting to get through the 2016 election without having to deal with it again, the Republican Congress agreed with the Obama White House not to call the question of authorizing the debt ceiling again until March 16 this year.

In the 2015 debt ceiling suspension deal (with two seats vacant) the vote in the House, then controlled 246-to-187 by Republicans, was 266 in favor to 167 opposed.

All 187 House Democrats voted to keep the United States in business, 79 Republicans joined them voting yes. The other two-thirds of Republicans, 167 GOP members, voted no.

In the Senate, with Republicans in control 54-to-46, 18 Republicans, just one third of GOP senators, joined all 44 Democrats and two independents to do their constitutional duty.

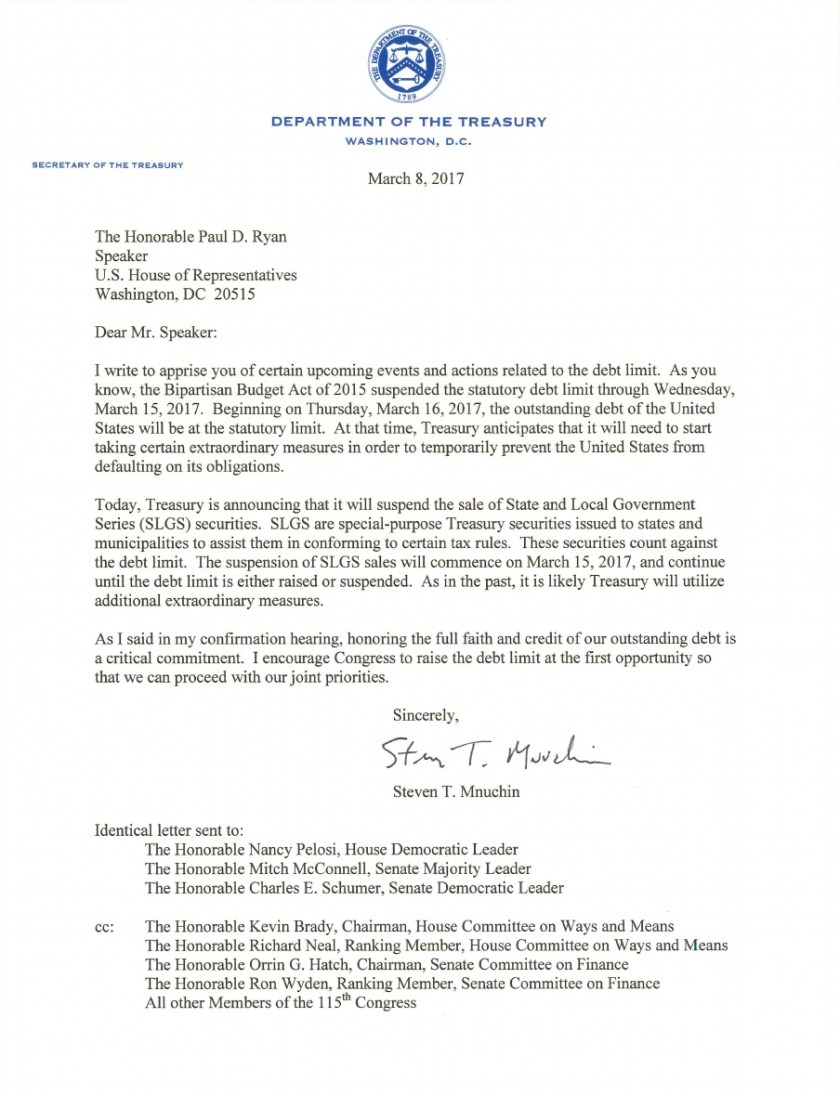

Right now, and since March 16 we have not had an authorized or even further suspended debt ceiling. Having been through this several times since 2011 we know that the U.S. Department of the Treasury can manipulate and move revenue and expenditures around and do other hocus pocus things for several months (see the letter from the treasury secretary to Congress appended at the end of this article for the first announcement of such measures).

But it is estimated that some time between May and July the Treasury will run out of tricks and we will be up against it as we were in 2011 when the refusal of the vast number of House Republicans to vote to raise the debt ceiling caused what was called “a government shutdown”. April 1 is upon us and that risk is coming round again but with two big differences.

First, a Democrat is not in the White House to create a counterpoise to uncompromising Republicans or a rallying point for the Democratic minority in the House. And, as we saw with the health care debacle, Republican leadership is unable to make the Freedom caucus drink from anything but its own poisoned policy well. Further, when it comes to the debt ceiling among Republicans in Congress more than just the members of the Freedom Caucus have shown themselves unwilling time and time again. The evidence says most or all of the 193 Democrats will be needed to vote yes.

Except this time there is a Republican President, who didn’t know health care policy is complicated and who, you can surmise, knows little or nothing about what you are reading here. Notwithstanding his personal experience with bankruptcy, this will likely take him largely by surprise

If Donald Trump discovered only last week that Abraham Lincoln was the first Republican president – yep he said he just heard that last week — do you have a lot of confidence that he knows much about any of this?

The second and probably more decisive difference is that since the health legislation fiasco it is clear there are not two parties in the United States Congress and especially so in the House of Representatives.

There are now, it seems, at least three parties in the Congress, possibly four, and a three-party system is simply not and never has been supportable, workable or doable in the American Constitutional system.

It has never worked, it cannot work, it will not work. Only a great big grand bargain beyond the limited imagination of Congress or this White House can solve the looming debt-ceiling drama and dilemma if it erupts true to recent past form.

During the past six years with a Democrat in the White House and Republicans in control of the House of Representatives, Democrats have provided two thirds of the votes to raise the debt ceiling.

But now, there is a Republican in the White House and no reason in the world for Democrats in Congress to vote “To borrow money on the credit of the United States” to bail out Republicans, who control both houses and the presidency and therefore bear the weight of responsibility.

For more about that, see Part II of this in a day or two.

-0-

Below is the letter dated March 8 from Secretary of the Treasury Steven T. Mnuchin to Speaker of the House Paul Ryan advising of the debt ceiling suspension expiration March 15; and describing Treasury’s first measure to meet the cash needs of the federal government.